Becoming a CoW Protocol solver is more than running infrastructure. It's an algorithmic arms race where the prize is user surplus. The core of this challenge is the solver engine, an intelligent system that must navigate the complexities of DeFi to find the most optimal settlement for a batch of user trades.

AzothSolver’s Approach

AzothSolver applies this roadmap with a focus on sub 5ms latency using Frankfurt-based bare metal servers and Rust-based algorithms. Our goal is to compete in the CoW Protocol shadow competition in Q4 2025. See the whitepaper for details.

Anatomy of an Auction

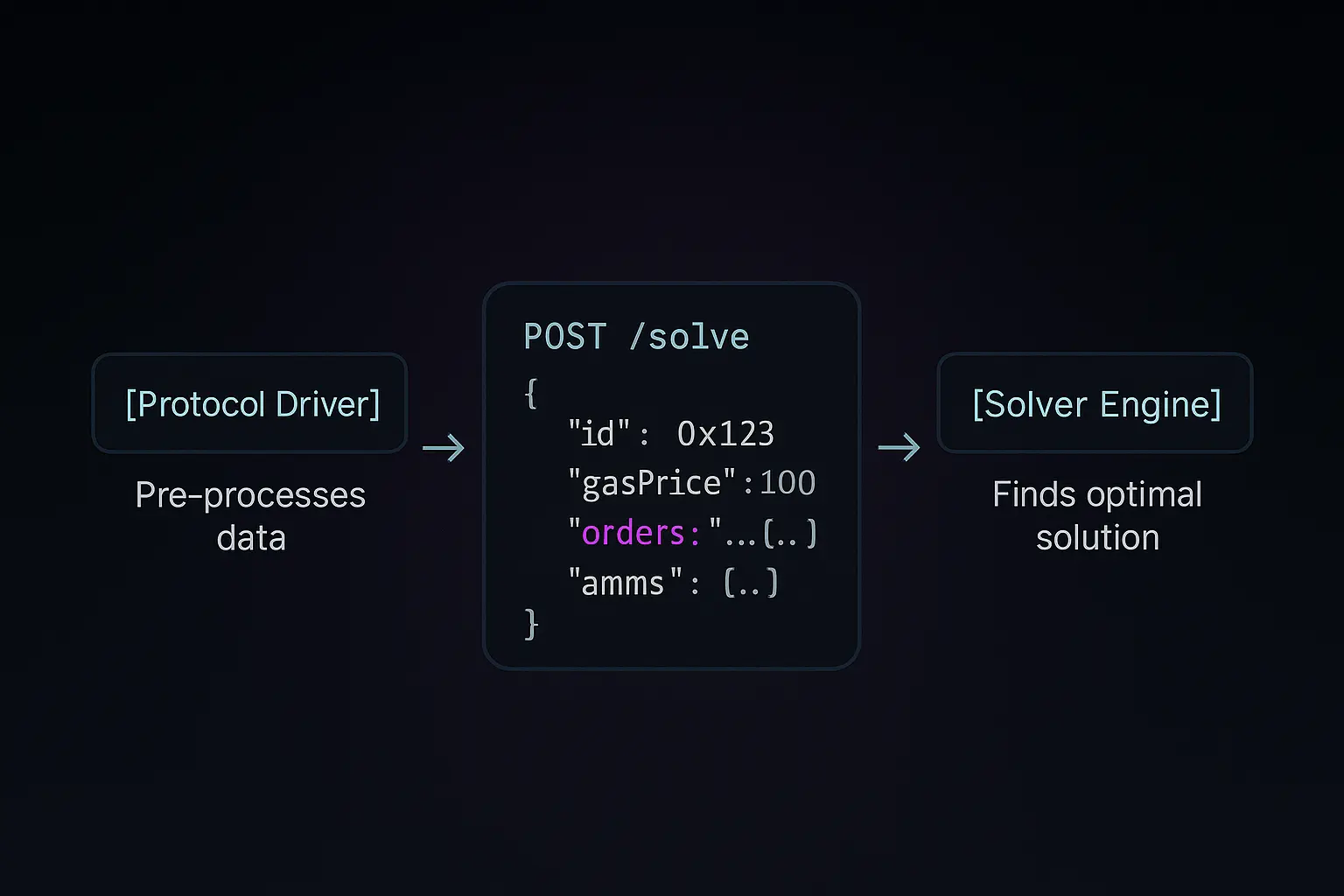

Periodically, based on auction cadence, the protocol sends a JSON payload to the solver's /solve endpoint. This is the entire problem space. Understanding its structure is the first critical step.

Anatomy of a CoW Protocol auction round — from request to solver execution.

The solver receives a clean, actionable problem set, allowing it to focus on optimization rather than data validation. The most critical data points are the user orders and the available on-chain AMMs.

Foundational Strategy: Optimal Pathfinding

Before finding CoWs, a solver must master routing trades across on-chain liquidity. This is modeled as a dynamic graph problem where the "best" path depends on trade size.

Choosing the Right Algorithm

| Algorithm | Use Case in Solver | Splits Orders? | Finds Arbitrage? |

|---|---|---|---|

| Dijkstra | Too simple; fails with dynamic trade costs. | ✗ | ✗ |

| Bellman-Ford | Excellent for detecting arbitrage (negative cycles) to capture as user surplus. | ✗ | ✓ |

| Max-Flow Min-Cost | The canonical approach for splitting large orders across multiple pools to minimize slippage. | ✓ | ✗ |

| Numerical Optimization | A practical way to solve the complex, non-linear problem of maximizing output across multiple AMM curves. | ✓ | ✗ |

A competitive solver combines multiple algorithms: one for arbitrage detection and another for optimal order splitting.

The Core Edge: Mastering Coincidence of Wants (CoWs)

The true power of CoW Protocol is settling trades peer-to-peer, avoiding AMM fees and slippage. A solver's ability to find these "CoWs" is its primary source of alpha.

Simple CoW

A direct peer-to-peer trade. Alice wants to sell ETH for USDC, Bob wants to sell USDC for ETH. The solver matches them directly.

ETH → USDC

USDC → ETH

Ring CoW

A multi-party trade forming a closed loop of liquidity. This is the most valuable and complex CoW to find.

A → B

B → C

C → A

The Solver's Toolkit

Top solvers gain their edge by optimizing at the margins. These advanced techniques separate the winners from the rest of the pack.

Precision Gas Estimation

Internal gas models and simulation beat standard estimates, leading to more competitive bids.

Superior Liquidity

Integrating DEX aggregators and private market makers provides better pricing than baseline AMMs.

Benign MEV Capture

Using arbitrage profits to improve user prices, not for personal gain, increases the solution score.

Flash Loans

Unlocking complex settlements and arbitrage with virtual capital, increasing capital efficiency.

Benchmarking for Victory

A solver is a dynamic trading agent. Success requires constant monitoring, analysis, and iteration based on key performance indicators (KPIs) from the risk-free Shadow Competition. Note: KPI values below are illustrative for demonstration.

Key Performance Indicators

The Iterative Development Cycle

1. Hypothesize

"Integrating a new PMM will improve my win rate."

2. Implement

Code the new liquidity source adapter.

3. Test (Shadow Competition)

Deploy and collect data risk-free.

4. Analyze & Iterate

Compare KPIs, reverse-engineer losses, and repeat.

Development Timeline

AzothSolver’s implementation of this roadmap is structured in phases to achieve competitive performance in the CoW Protocol ecosystem.

Q3 2025: Infrastructure Setup

Deploy Frankfurt bare metal servers and telemetry systems.

Q4 2025: Shadow Competition

Launch core solver and participate in CoW Protocol’s shadow competition.

Q1 2026: Algorithm Optimization

Refine algorithms based on competition data.

Q2-Q3 2026: Network Expansion

Expand to Ethereum mainnet and additional networks.

Contact Us

Reach out at azothsolver@gmail.com

Follow us on X - @AzothSolver

Check out our code on GitHub - @AzothSolver